#Invest #Sports #Memorabilia #WorthPoint

I’ve often trumpeted many of the “whats” for sports memorabilia collecting and investing, but today, I’m answering one of the other 5 Ws: the “why.”

Review of the Sports Memorabilia Marketplace

Back in the late 1980s and early 1990s, the sports memorabilia world blew up in a big way as the once-innocent hobby became a marketplace and investor haven. The population threw big bucks into cards, autographs, and gear, with growth potential reigning supreme.

Then, the bottom fell out. For various reasons, sports memorabilia fell by the wayside as collectors and investors looked elsewhere, and for decades, it was a select population that stayed in the memorabilia world.

While the sharp pandemic-induced sports memorabilia fervor has died down amid inflation and a return to normalcy, many investors are staying in the category and continuing to put significant dollars into collections that rival halls of fame and museums worldwide.

If you’re interested in investing in sports memorabilia, now’s a good entry time, as asserted by Market Decipher. In a press release promoting its “Sport Memorabilia Market” report, the company stated that “research estimates the sports memorabilia market size at $26 billion in 2021 and is expected to reach 227.2 billion by 2032, growing at a compound annual growth rate (CAGR) of 21.8 percent during 2022 to 2032.”

This growth is not only taking place in North America. “The United States leads the industry on a regional basis with around 70 percent of the market in 2021; however, the Asia Pacific countries are picking up swiftly experiencing a growth of 34 percent in the overall sports memorabilia collectibles market,” Market Deciper stated in its release. “China is a huge market for collectibles in comparison to other countries with a sumptuous growth. India, the global IT powerhouse, is also emerging as a major NFT destination.”

If you, as an investor or a curious collector, are sitting on the fence about sports memorabilia, allow me to justify what outlets like Market Decipher are saying and what I’ve spent decades preaching—sports memorabilia is where you should be putting your dollars.

The Settling Point

Before I start soapboxing, I will put a proviso in place: You will see immense volatility when looking at a newly released memorabilia piece, say, a new trading card set. For example, Connor Bedard‘s Upper Deck rookie cards, released just a few weeks ago, hit their apex during the first couple of days in secondary-market action. Since then, sales have simmered as more pieces of products come out.

So, if you’re a short-term investor, the best get-in, get-out move will be to hit a marketplace within a week of a product’s release.

There’s a fundamental principle in sports memorabilia: an item usually keeps value once it reaches a settling point. This period comes a couple of years into a player’s career. A hot rookie could be a dud as a sophomore as opponents learn the tricks of their play and match up against them.

For the subsequent five to ten years of their career, with a few exceptions, a player will perform at an expected level, be it averaging twenty-five points per game in basketball or hitting the 1,000-yard mark annually in the NFL. There will be anomaly seasons and a natural decline in post-prime years. Still, aside from short-term bumps or dips, memorabilia around a particular player will stay on an even keel.

Actual increases occur when a player hits certain milestones, like the 500 Home Run Club, wins a league championship, or wins another hardware award (MVP, scoring leader, etc.). Falling short of milestones doesn’t hurt a player’s value, while premature career ending due to injury or health issues doesn’t impact either. Bo Jackson‘s continued popularity despite the brevity of his career is an example of this.

Rare Downward Trends

There are only a couple of instances where something will devalue, and most often, this is on an individual basis, either around the collectible or the depicted player.

For the collectible, the downgrade has a lot to do with alteration. As I’ve discussed before, restoration is a touchy subject, as most collectors still want a piece to be original. This could be touching up the color on a bat to improve its condition or using filler to fix blemishes on a glossy trading card. Similarly, in the eyes of many collectors, a trading card should not be touched up to improve its condition. Many third-party graders will put an “altered” or “restored” tag on these items, while collectors are keen to reject these pieces.

Then there’s the athlete. Unless there’s an offense, and I mean a major offense, then the chances of a player decreasing in value once they’ve reached their market settle point are minimal.

Those significant offenses, however, do pop up, and we’re staring one in the face right now as Shohei Ohtani sits under intense scrutiny amid gambling accusations. If Ohtani is found to have any connection to his interpreter’s betting and is suspended from the league temporarily (or worse), his memorabilia will see a negative impact.

Precedence is here with Pete Rose. Longtime collectors will undoubtedly recall Beckett Baseball Card Monthly‘s feature on hot and cold players. Almost every month, without fail, Pete Rose was at the top of the ice list because of his connection with the gambling world. While the all-time hit king has recovered in hobby popularity to an extent, he’s nowhere near the theoretical level he should be.

This trend comes with caution before you list your Ohtani autographed photo—not every indiscretion affects a player’s memorabilia market. Tiger Woods collectibles emerged virtually without a scar after the golfing icon’s very public infidelity scandal broke. In another case, several members of baseball’s steroid era, despite not being named to Cooperstown, remain popular with collectors.

Quantitative Non-Theory

A player’s sheer number of autographs does not negatively impact their desirability.

For a moment, think about how many autographs a player at the level of Tom Brady or Michael Jordan signed over their careers and continue to produce. It’s not impossible to imagine that this number goes into the six or even seven figures. Any player who sniffs the pros will put pen to photo or gear hundreds if not thousands of times in a short span.

Yet, the quantity doesn’t affect their value, even after they pass on. If anything, the price tag goes up because there is now a finite number on that individual’s signature, regardless of what that total is.

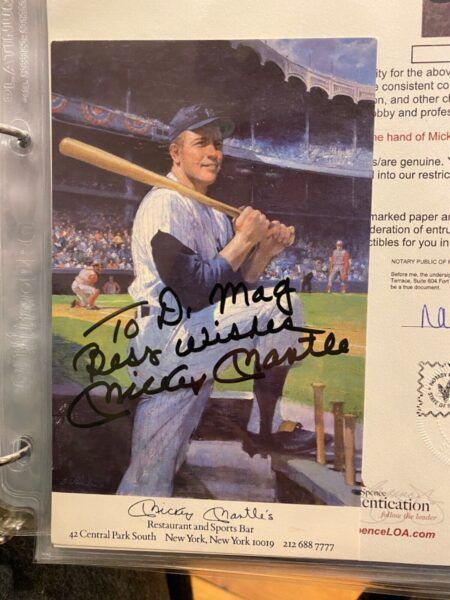

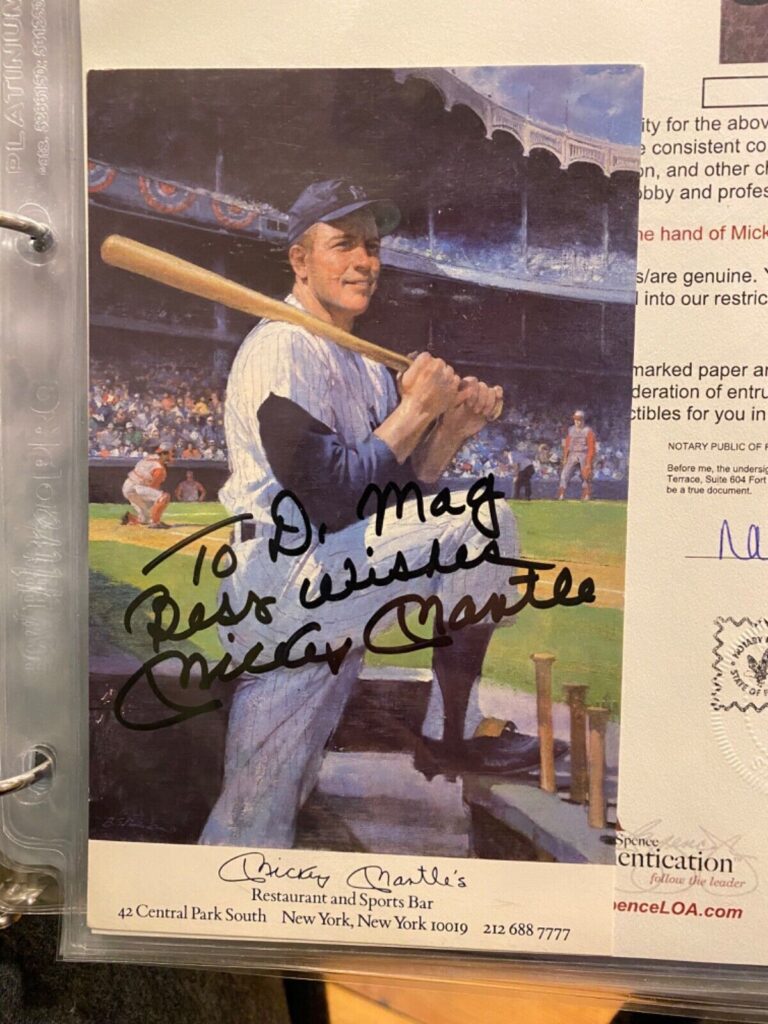

I’ll put out Mickey Mantle, who passed away in 1995, as my first evidence. There are nearly three decades of potential autographs from The Mick that today’s collecting world has missed out on. However, he was alive during the hobby’s boom period, signing liberally at shows and often for those who met him in public or sent requests through the mail (let alone the countless baseballs, programs, and notebooks he imprinted during his career). So, let’s arbitrarily put his signature quantity in the tens of thousands. That’s a high number for just about any memorabilia, but as more autographs hit the market through auction and sale, the realized prices don’t drop dramatically.

Now let’s apply the theory to current superstars such as LeBron James, who is just about at career’s end. Basic economic logic would state that there’s more supply than demand for his collectibles, namely his autograph, and that the bottom will fall out. Yet, you could have tried making that argument countless times over the last decade, but he’s remaining hot. The same goes for any of his teammates or the vast majority of the NBA population (except young players).

Simply put, the general economic theory of supply and demand doesn’t apply. In my twenty years in hobby media and analysis and thirty-plus years as a collector, I’ve never heard someone say there are too many Wayne Gretzky signatures and that they’re going down in value. The supply is exceedingly large, yet no one is doing fire sales, nor have the companies The Great One works with said they are limiting supply going forward.

There are plenty of other reasons to invest in sports memorabilia, which I will discuss in future columns. For now, start browsing our WorthPoint Price Guide and thinking about what segment is best for you.

Jon Waldman is a Winnipeg-based writer. He has written for Beckett, Go GTS, Canadian Sports Collector, and several other hobby outlets over his two decades in the hobby. His experience also includes two books on sports cards and memorabilia. Connect with Jon on Twitter at @jonwaldman.

WorthPoint—Discover. Value. Preserve.