#Upcoming #Auction #Spotlights #Gold #Rush #History #WorthPoint

Image courtesy: Ira & Larry Goldberg Auctioneers

The United States has always been a country of high growth, with booms, busts, and panic attacks. This is the history of America. Today, we panic about global warming; yesterday, we panicked over COVID-19. In the mid-1800s, a rapid, nationwide financial panic overtook the country, catalyzed by the 1857 shipwreck of the SS Central America, which had been carrying millions of dollars in gold gained from the waning California Gold Rush. Although the country’s economy had been booming in the years prior, declining stocks and the loss of crucial gold needed for US coinage and bank reserves poised the stretched economy for a bust instead.

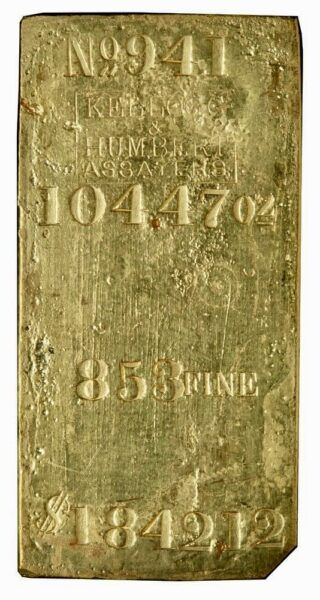

And now, WorthPoint Industry partner Ira & Larry Goldberg Auctioneers is auctioning one such gold item recovered from that fateful shipwreck: a gold ingot molded by the well-known Kellogg & Humbert Assayers. As the auction house notes, this gold bar represents many individuals’ efforts toiling years in streams and valleys during the California Gold Rush to recover gold nuggets and, more often than not, tiny gold dust traces. But these fortunes promised in the West were later lost at sea on the way to the East, compiling the financial issues that launched the Panic of 1857.

The Challenge of Coinage in the Growing United States

While the country was benefiting from the California Gold Rush and the first public electrical telegraphs in the 1840s, there was a simultaneous growing need for banks to have hard currency reserves. The US had grown quickly, and so, too, had the cost of everything. Although the country’s western edge promised precious and semi-precious metals that could fuel the economy, there was a problem: The New West needed coinage for itself and a mint to make it. On the other hand, the older East Coast needed its coin supply and had mints but lacked precious metals.

The country solved this by creating coin mints in San Francisco, Carson City, and Denver. (In addition to minting silver and copper, the San Francisco Mint processed more than $4 million worth of gold coins in its first year, 1854.) Then, to get gold from California to the hungry mint in Philadelphia, which was feeding a needy and growing immigrant-fueled country, the East relied on an age-old solution: a treasure ship laden with gold.

From California Gold to United States Mints

While sending California’s gold back to the East by steamship may seem easy today, it was not a simple task in the 1850s. The arduous process began with digging and gathering the gold from the earth, often by hand. The arduous process began with digging and gathering the gold from the earth, often by hand. The gold was then smelted and delivered to an assay office like Kellogg & Humbert in San Francisco. Once the gold was assayed, converted into gold bars, and stamped with identifying marks from the assayer, the ingots were moved to be loaded and transported by ship.

In 1857, the world was very different than today. In America, California gold was worth approximately $20 per ounce and was becoming a world financial reserve standard, replacing silver as a reserve currency. Additionally, neither the Panama Canal nor transcontinental railroads existed yet. Thus, transporting raw bullion from San Francisco to the Philadelphia Mint was long and dangerous. Moving cargo from the Pacific to the Atlantic involved a trip around the tip of South America or overland through countries like Panama. Gold was much more suited for this trip than silver—although denser and thus heavier pound per pound, gold consumed a fraction of space per dollar.

The Panic of 1857 and the Sinking of the SS Central America

Seeds of a financial meltdown had already been sowed earlier in 1857. In addition to declining railroad stocks and the failure of N.H. Wolfe and Co., New York’s oldest and most prominent flour and grain company, the Ohio Life Insurance and Trust Company failed, creating anxiety for other banks and its customers.

Then, in September 1857, the SS Central America left port in what is now Panama, carrying a massive amount of treasure bullion from the California gold mines en route to New York. But the aptly nicknamed “Ship of Gold” never reached its destination. The steamer battled the winds and rough seas of a hurricane and sank on September 12, becoming the “greatest sea disaster in the nation’s history” at the time. Only about 30 percent of the ship’s passengers and crew lived, and the rest of its cargo, including tons of gold ingots, coins, and nuggets, was lost to the bottom of the ocean, where it remained until 1988.

After the ship’s sinking, the US and global economies plunged into a full financial crisis. Fear drove the stock market to bottom out as many withdrew their money from banks, leading several to collapse.

The 104-Ounce Gold Bullion Bar: A Historical Treasure

In its June pre-Long Beach Auction, Ira & Larry Goldberg Auctioneers is featuring a trophy item from that salvage. Lot #485 includes a 104-ounce gold bar stamped by the infamous assayer of the time, Kellogg & Humbert. Although the auction house estimates it at $300,000, I would say this is low and a bargain. Why?

What is the premium for this gargantuan salvaged relic lost nearly 170 years ago? Comment your thoughts and predictions. As for this gold bar, I will watch and report back. It’s a key item in the three-part sale by Ira & Larry Goldberg Auctioneers, a fabled auction house and important Industry Partner of WorthPoint’s. I expect these auctions will be exciting.

Will Seippel is the founder, president, and CEO of WorthPoint. Will has been an avid collector since 1974 and dealer of just about all things antique—with an emphasis on ephemera— since 1984. He is also the creator and founder of HIP, a website devoted to recording the best of the world’s history that has been saved on film.

WorthPoint—Discover. Value. Preserve.